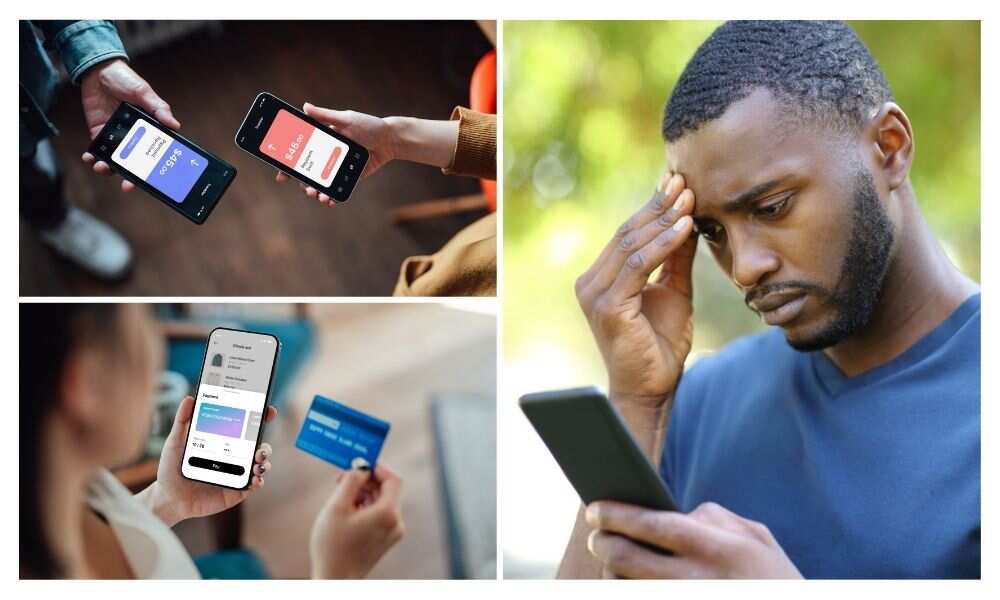

- Nigerians are dumping their bank apps and embracing alternative platforms

- Bank customers say they have never experienced the sort of glitches they have been witnessing in recent weeks

- To cope with the situation, bank customers have named their preferred alternatives to failing bank apps

It appears banks are failing their customers in their numbers and cannot handle the volume of transaction requests by Nigerians.

Since the beginning of the Central Bank of Nigeria (CBN)’s cashless policy, Nigerians have expressed utter disappointment and disgust with their financial institutions, which they hitherto relied on for seamless transactions.

It seems most bank platforms and infrastructure were not built for the heavy usage that the naira redesign policy and cash scarcity have created.

The cashless policy has exposed the weaknesses of the banking infrastructure in Nigeria, leading to a loss of confidence on the part of customers.

Nevertheless, the transaction glitches experienced by bank customers have benefitted other platforms, which had tough times wooing customers before now.

Nigerians rush Opay, PalmPay, and others

It is common to see payment platforms such as Opay, PalmPay, PiggyVest, and others trending on social media for the best reasons.

Nigerians, in their numbers, say they have chosen them as the last-minute resort due to disappointments from the conventional banks.

According to reports, Opay, which launched operations in Nigeria about five years ago, has been downloaded 10 million times by users. The number has spiked in the last three months since the CBN cashless policy began.

The platform boasts over 18 million users nationwide and has received some of the best ratings on App stores.

Customers afraid of cyber attacks and hacks

But users expressed mixed feelings, saying they are very cautious of the platform and can only leave disposable amounts in their accounts.

Jonathan Ihechi, one of the users of the payment platforms who spoke to Legit.ng, said that as much as most of the transactions done on the platform are hitch-free, he only maintains a minimum balance in the app to avoid losing his funds.

He said:

“Recently, we heard that one of the payment platforms was hacked, and billions of naira moved from it. Imagine users who had huge money on the platform losing out.”

But cyberattacks are not the only thing on users’ minds. The legality of using such platforms is also a cause for concern. They worry if they are licensed and permitted to operate legally in Nigeria.

“Many people I have encountered ask if the platforms are operating legally and what happens if they lose funds,” Ihechi stated.

However, most platforms are licensed by the CBN and Nigeria Insurance Deposit Corporation (NDIC) because they operate in the financial ecosystem.

These platforms have been able to wrap themselves around the fabric of society and have been massively adopted as reliable alternatives to the epileptic services rendered by conventional banks.

Mariam Babajide said she depends on some payment platforms for hitch-free transactions.

She said:

“For my NYSC, I served in a village in Imo State and always had no problem using some payment platforms.”

For most Nigerians, the time has come to understand when to hope on their banks for reliable transactions.

Naira swap, banking troubles: Nigerians name alternative platforms for saving, seamless transactions

Recall that Legit.ng reported that following moves by the Central Bank of Nigeria (CBN) to swap old naira notes for new ones and its February 10, 2023, deadline, many banks in the country are at their wit’s end due to the volume of hiccups in transactions.

Reports of glitches from banking platforms have left many in Nigeria exasperated, frustrated, and yearning for better alternative savings platforms.

Experts believe that the current bank woes, caused by scarcity of cash, have unearthed the underbelly of Nigeria’s banking industry, showing how unready the entire banking sector is for the much-touted cashless policy of the Central Bank of Nigeria.